IBL News | New York

The Biden administration said this week that it will forgive all of the loans held by 560,000 students who attended the defunct Corinthian Colleges, one of the nation’s largest for-profit college chains, before it collapsed in 2015 after it was found guilty of defrauding students.

This debt amounts to $5.8 billion and is the largest single debt cancellation ever by the Federal Government. This Corinthian College discharge is twenty times larger than the Marinello Schools of Beauty, a predatory for-profit organization that deceived 28,000 students.

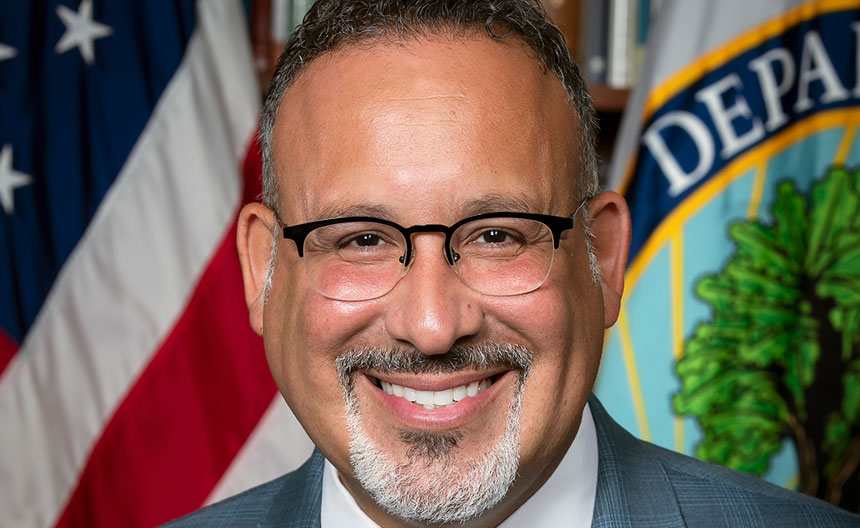

“For far too long, Corinthian engaged in the wholesale financial exploitation of students, misleading them into taking on more and more debt to pay for promises they would never keep,” said Education Secretary Miguel Cardona. Corinthian Colleges mislead students about job placement prospects after graduation.

Vice President Kamala Harris announced the group discharge yesterday.

In 2013, Kamala Harris, at the time California’s Attorney General, sued Corinthian for using fraudulent advertising and other predatory practices.

At its peak, Corinthian had more than 110,000 at 100 campuses across the country.

In 2015, the Education Department joined the investigation and fined the organization $30 million. This event made Corinthian sink into bankruptcy, closing its 28 campuses with 16,000 students.

Later, over 1,000 students went on strike, refusing to pay back their student loans.

Today, the Biden administration will automatically forgive students’ debts. Borrowers will even be refunded on past payments if they still have an outstanding balance. However, borrowers who have fully paid off their loans will not be refunded.

Borrowers and their advocates celebrated the Corinthian decision as a watershed moment.

However, former Education Secretary Bill Bennett called the debt forgiveness “regressive” and a “mistake.” “Now, Corinthian Colleges were a scam, and they were putting a scam on a lot of students. They deserve some punishment and some accountability, but that does not mean the taxpayers have to pay for that, which is what we are doing here,” he added.