IBL News | New York

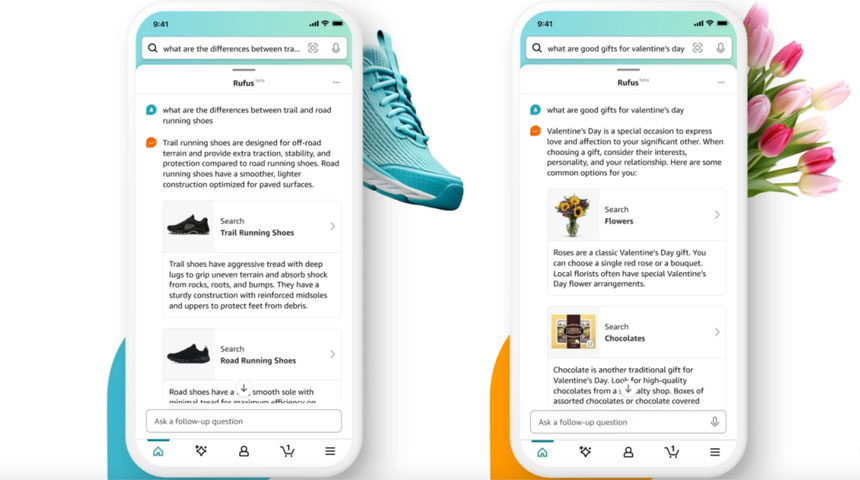

Amazon launched this month in beta an AI-powered shopping assistant called ‘Rufus’, trained on the company product catalog, customer reviews, community Q&As, and information from across the web. It’s available to select customers when they next update their Amazon Shopping app.

Built on an internal LLM specialized for shopping, this conversational assistant answers customer questions on a variety of shopping needs and products, provide comparisons, and make recommendations based on conversational context.

“Rufus knows Amazon’s selection inside and out, and can bring it all together with information from across the web to help them make more informed purchase decisions,” said Amazon.

“With Rufus, customers can:

- Learn what to look for while shopping product categories: Customers can conduct more general product research on Amazon, asking questions such as “what to consider when buying headphones?”, “what to consider when detailing my car at home?”, or “what are clean beauty products?” and receive helpful information to guide their shopping mission.

- Shop by occasion or purpose: Customers can search for and discover products based on activity, event, purpose, and other specific use cases by asking a range of questions such as “what do I need for cold weather golf?” or “I want to start an indoor garden.” Rufus suggests shoppable product categories—from golf base layers, jackets, and gloves to seed starters, potting mix, and grow lights—and related questions that customers can click on to conduct more specific searches.

- Get help comparing product categories: Customers can now ask “what’s the difference between lip gloss and lip oil?” or “compare drip to pour-over coffee makers” so they can find the type of product that best suits their needs and make even more confident purchase decisions.

- Find the best recommendations: Customers can ask for recommendations for exactly what they need, such as “what are good gifts for Valentine’s Day?” or “best dinosaur toys for a 5-year-old.” Rufus generates results tailored to the specific question and makes it quick and easy for customers to browse more refined results.

- Ask questions about a specific product while on a product detail page: Customers can use Rufus to quickly get answers to specific questions about individual products when they are viewing the product’s detail page, such as “is this pickleball paddle good for beginners?”, or “is this jacket machine washable?”, or “is this cordless drill easy to hold?”. Rufus will generate answers based on listing details, customer reviews, and community Q&As.”

TechCrunch said that it’s worth pointing out that Amazon’s AI chatbot Q for businesses has struggled, producing hallucinations (false information) and revealing confidential data.