IBL News | New York

Domain-specific applications using domain-specific data will unlock a lot of value and competitive advantage, said Coursera’s CEO Jeff Maggioncalda at Davos during the 54th annual meeting of the World Economic Forum.

“Don’t try to build the next LLM for the world, try to build some domain-specific language models,” he stated. “It’ll be difficult to build businesses, unless you’re building foundation models.”

“There is a huge untapped opportunity in building generative AI applications over building large language models (LLMs),” added Andrew NG, the founder and CEO of Landing AI and former CEO of Coursera.

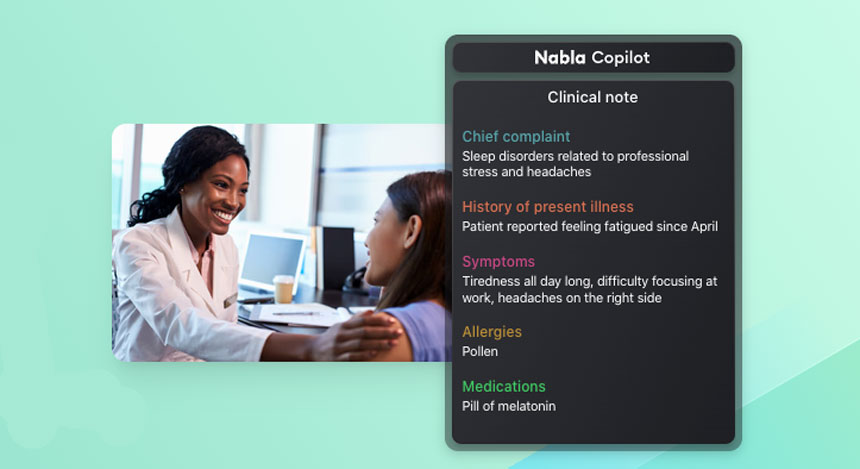

“There are so many more opportunities in applications of AI to healthcare, financial services, IT consulting, and so on. These have huge opportunities that relatively very few people are working on,” said Ng.

.

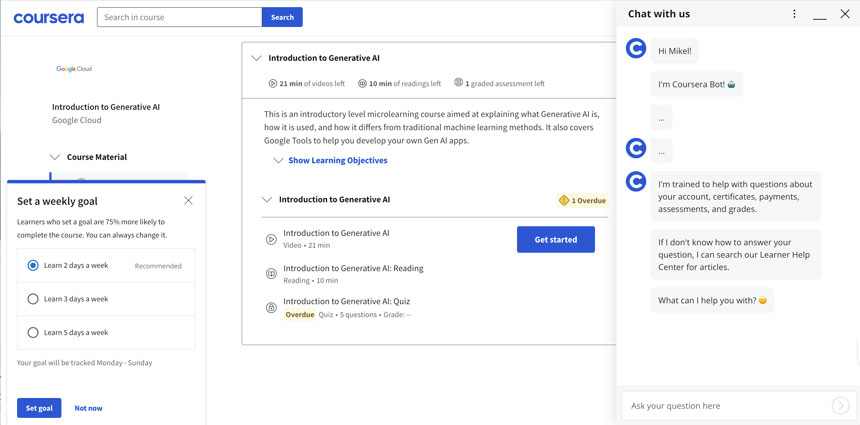

Update: On Thursday, January 18, Jeff Maggioncalda said that Coursera added a new user every minute on average for its artificial intelligence courses in 2023. The platform has more than 800 AI courses and saw more than 7.4 million enrollments last year.

Every student on the platform gets access to a ChatGPT-like AI assistant called “Coach” that provides personalized tutoring.

The chatbot uses OpenAI and Google’s Gemini’s LLMs.

Maggioncalda said that the company does not plan to build or train its own models.“We’ll probably be fine tuning with proprietary data just on top of these large language models.”

Coursera has also used the technology to translate about 4,000 courses in different languages and plans to ramp up hiring for AI roles this year.

![“Build Domain-Specific Language Models,” Said Coursera’s CEO in Davos [+Jan 18 Update]](https://cms.iblnews.org/wp-content/uploads/2024/01/coursera.jpg)