IBL News | New York

2U, Inc. (Nasdaq: TWOU) announced yesterday it completed its acquisition of edX Inc, the MIT and Harvard-created non-profit educational platform, sold last June by $800 million in cash. Now, edX will operate as a public benefit company property of 2U.

Along with the closing of the business, 2U decided to eliminate all membership and annual fees for current and future edX Consortium members — 230 in total, including 19 top universities — as a measure to keep them on board.

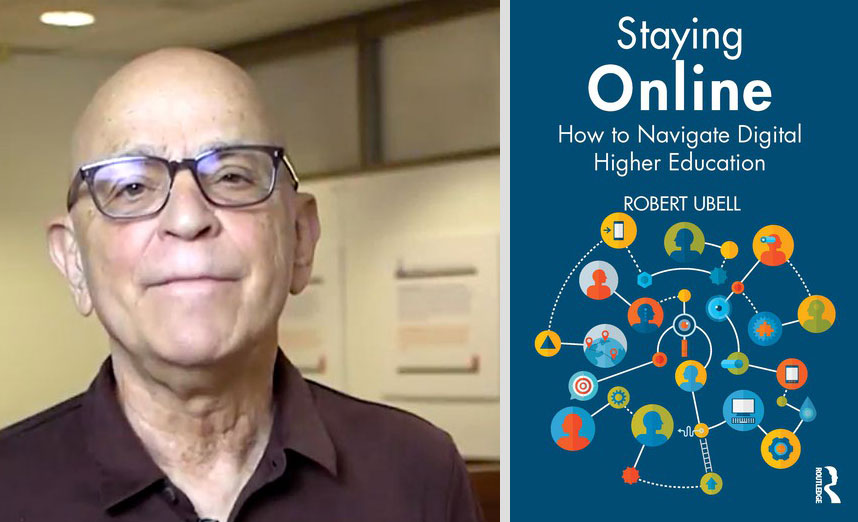

• Anant Agarwal, CEO at edX and professor at MIT, decided to join 2U after being named for a new executive position: Chief Open Education Officer. He will report to 2U’s CEO, Chip Paucek, and “will continue to steward the edX mission as part of 2U’s executive team.” [Both in the picture, above]

Moreover, the announcement indicated: “Anant Agarwal will serve as one of 2U’s representatives on Open edX’s new Technical Oversight Committee, responsible for guiding the technical direction and vision of the open-source platform and community to support learning outcomes around the world.”

• edX Chief Technology Officer JP Beaudry was appointed Chief Technology Officer at 2U, succeeding former CTO James Kenigsberg.

• edX VP of Product Lauren Holliday was appointed Managing Director of Open Courses & Marketplace at 2U.

As part of the closing, 2U and edX also announced, without further detail, “a marketing campaign this week to expand the reach of edX partner organizations”, as well as “a million dollars in funding to support the production of 10 new free courses in Essential Human Skills for the Virtual Age to be developed by the edX partner community.”

In addition, “edX partner Boston University has committed to launching a new disruptively priced Master of Public Health degree.”

2U reported that “more than 25 2U partners are joining the edX Consortium and committing to contribute affordable, high-quality learning to edX.org, including Howard University, London School of Economics and Political Science, Morehouse College, Syracuse University, UC Davis, the University of North Carolina at Chapel Hill, Vanderbilt University and others.”

The Lanham, Maryland – based company reinforced its commitment to “contribute to the ongoing development of the open-source platform Open edX.”

As part of the PR campaign, Chip Paucek and Anant Agarwal wrote a shared blog post titled “Potential, Unlocked.”